Nowadays, the neutral trend is quite common in the stock trading market. In a neutral trend, prices of assets do not move up or down; they move sideways. That is why neutral strategies are also called non-directional strategies. Unlike other investors, options traders can benefit from neutral market trends. Options traders can use neutral strategies to benefit from neutral trends in the stock market.

When options trader uses neural trading strategies, they can avoid market volatility or the rise and fall of stocks. Strangle, Straddle, Butterfly, and Conder are some popular neutral options trading strategies. An options strategy builder app can help you implement these neutral trading strategies. So, keep reading as we will discuss the top 5 neutral options trading strategies here.

1. Strangle

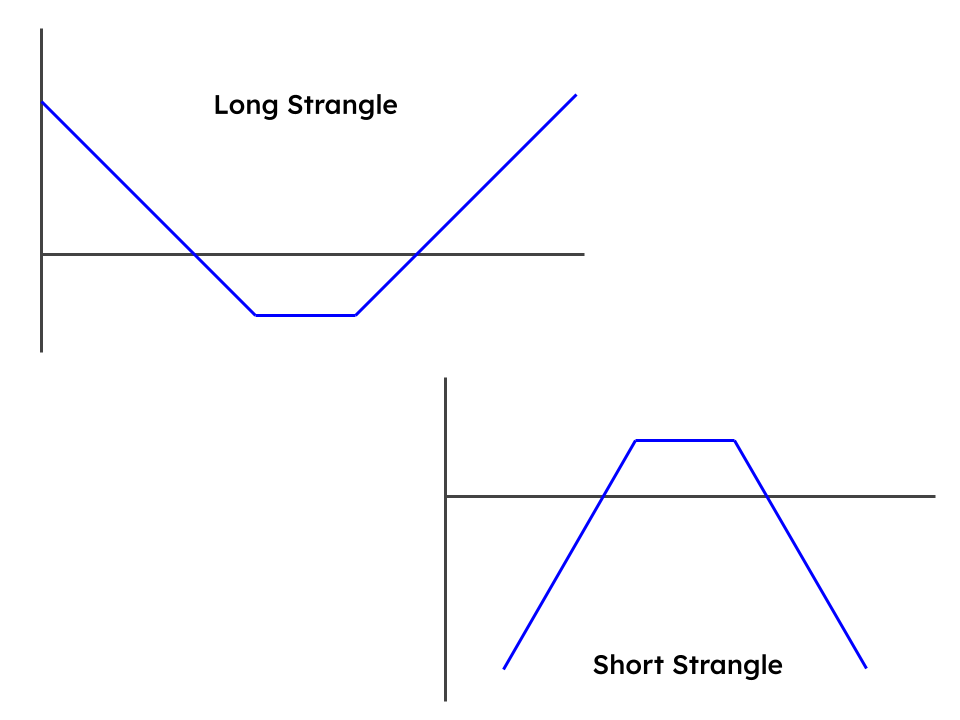

Strangle is one of the top neutral options trading strategies that compiles put option transactions below the strike price and call option transactions with a higher price strike. The strangle trading strategy is further divided into two different types – Long and short strangle strategy.

Long Strangle:

In a long strangle, investors buy one OTM call option, and one OTM put option of different price strikes. This strategy is beneficial if both option price moves either way. Long strangle is primarily used neutral strategy as it helps to gain profit when the price moves both sidewise.

The method is useful when the premium payables are less than the straddle during volatile swings in the market.

Short Strangle:

Short strangle strategy, similar to the long strangle also involves investment in one put and one call option. However, the only difference between the long strangle and short strangle is that in the long, investors buy call and put options and gain profit when the price move either way of the options but in the small strangle, they only gain profit when the price does not move much in either way by selling the call and put option.

The short strangle method is helpful in rangebound situations when the range is higher than the straddle range or premiums. In addition, options trading automation can help investors use long and short-strangle strategies.

2. Straddle

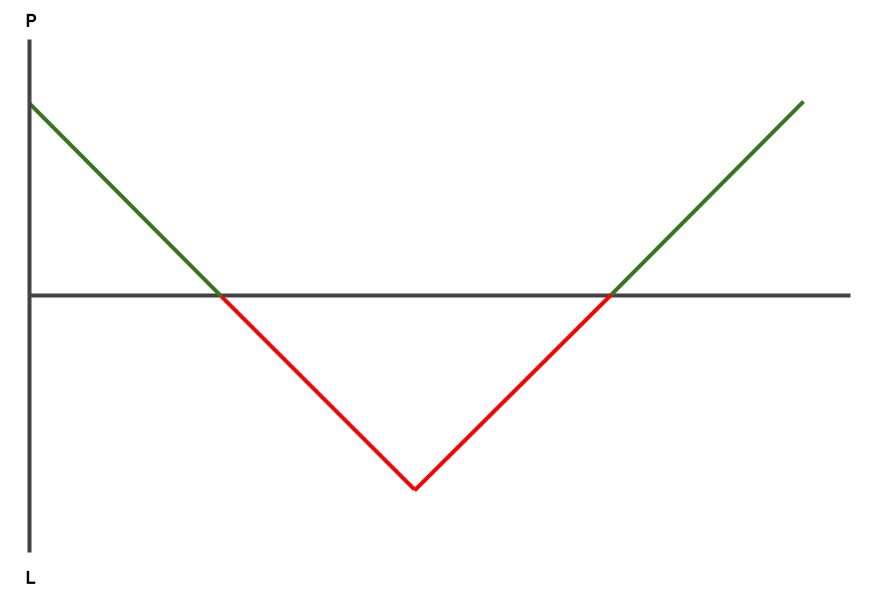

Straddle is another top neutral options trading strategy which is quite similar to the strangle strategy. Plus, the straddle is a very neutral options trading method that can bring substantial profit to investors. Unlike the strangle, where the investors transact put and call options of different price strikes, the straddle involves holding a position of both put and call options of the same price strike. Straddle is also further divided into two types – long straddles and short straddles.

Long Straddle –

Long straddle involves buying put options and call options of the same price strike. This method is useful when the options trading market is highly volatile.

Short Straddle

Unlike long straddles, short straddle always sells the call and put options of the same price strike. It is helpful when you expect narrow-range action. You can also use options strategy builder apps to identify the scope of straddle and implement it in your options trading.

Read More:

Online Stock Trading 101: A Beginner's Guide

3. Butterfly

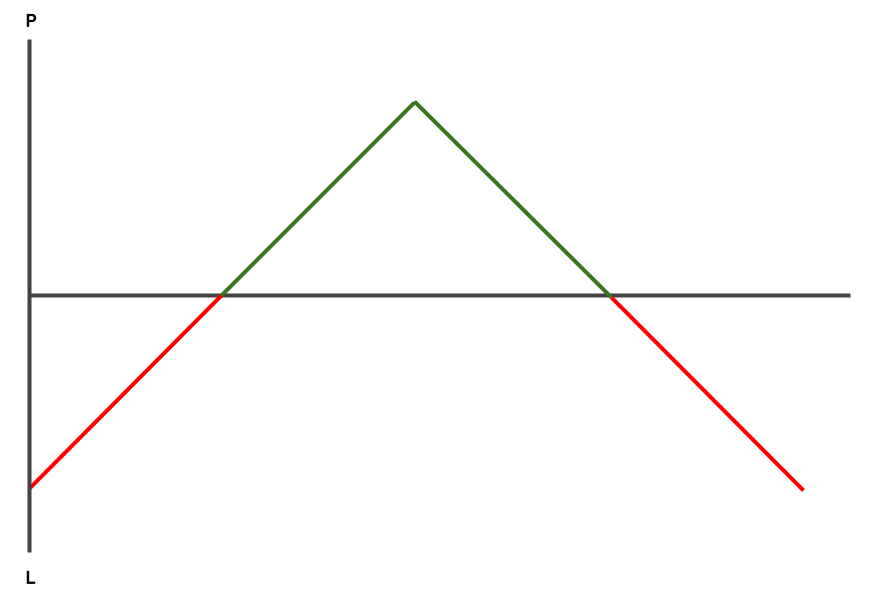

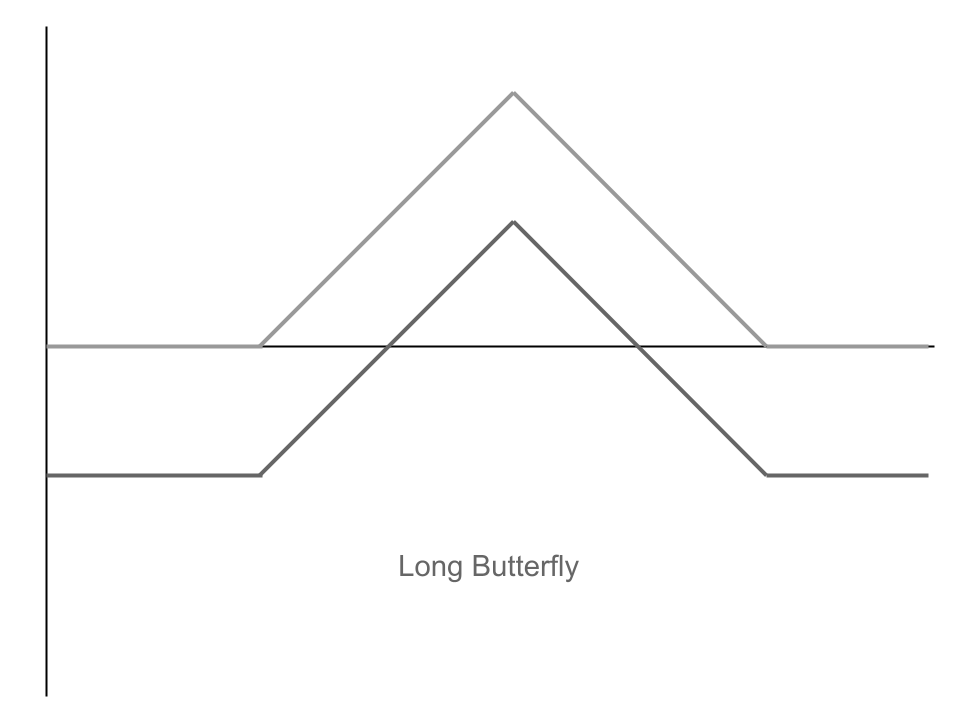

A butterfly spread is also a popular neutral options strategy, and options trading automation can help you implement this strategy. Butterfly involves bear and bullish transactions of four options with the same expiration date but three different price strikes. It also divides into two types- long and short butterflies.

Long Butterfly

Long butterfly involves buying one ITM (in-the-money) call/put, writing two ATMs (at the money), and then buying an OTM (on the money).

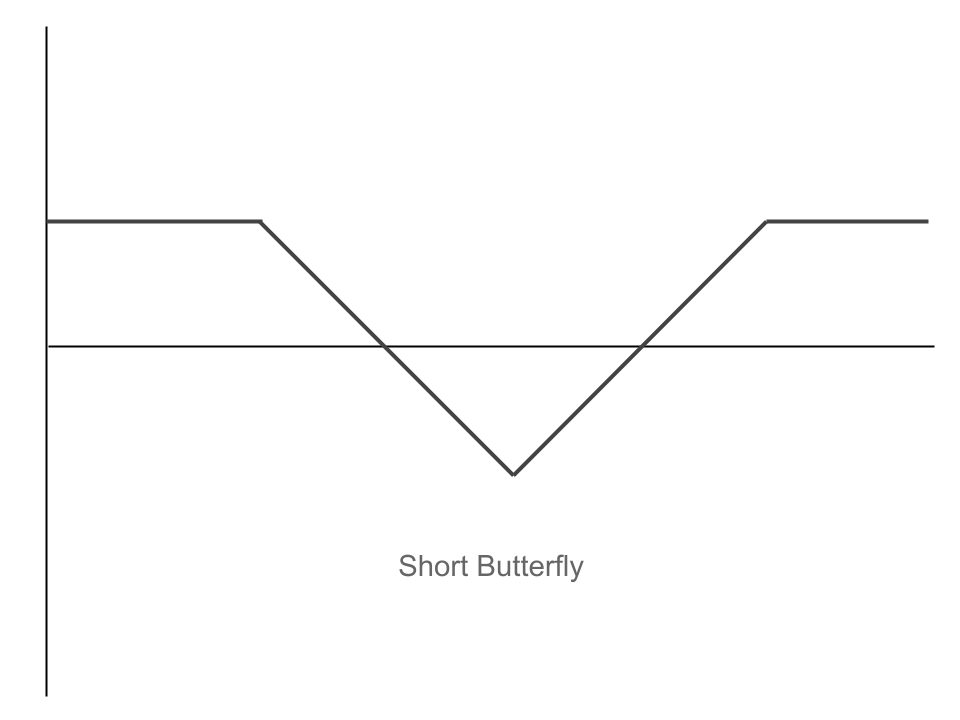

Short Butterfly

On the other hand, a short butterfly involves selling one ITM call/put option, buying two ATM call/put options, and then selling one OTM call/put option.

Get Your Custom Options bot Developed with SpeedBot

4. Covered Call

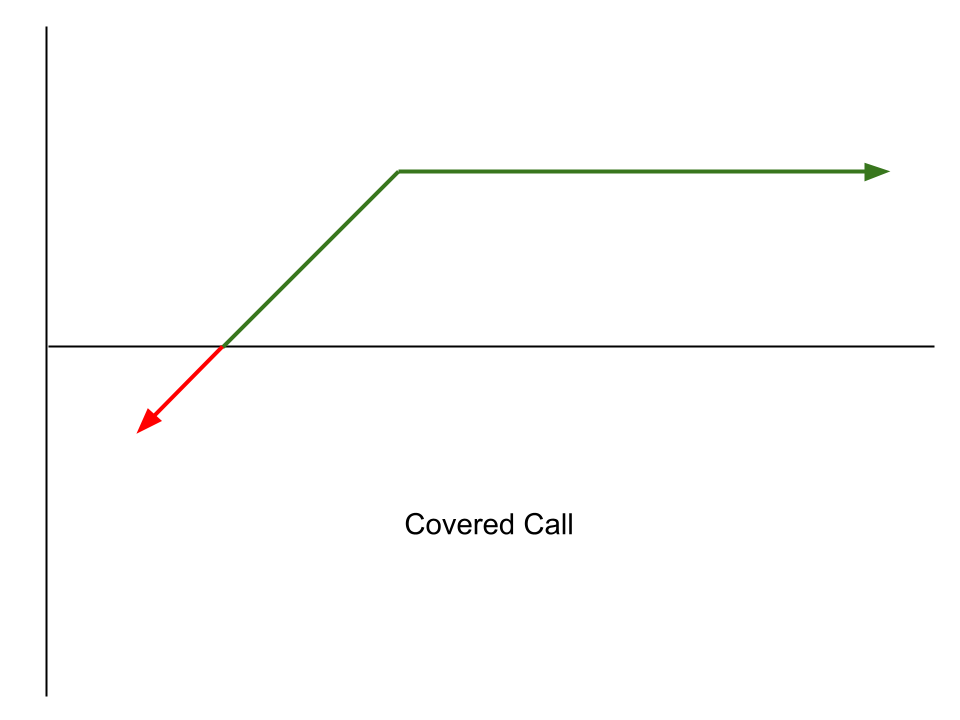

Another essential neutral options trading strategy is the covered call market strategy that depends on the anticipated stock price hike and is used to earn a limited amount of profit with a fixed volatility or market risk. In this method, an investor does not primarily aim to gain profit from the options. Instead, it concentrates on deriving profit from the stock at a neutral stage where the stock price does not move either way.

The covered call options strategy is a neutral options strategy with a slightly bullish tendency. Also, the risk proportion of this method is either low or defined where the risk placed is on the stock side. The covered call strategy is also a risk-averse option strategy that helps to reduce risks related to market losses.

A fine example of a covered call is when you purchase a stock with $60, assuming the price goes up about $70 in 10 years, yet sell the stock at $65 within six months to avoid the risk of stock at the same time compromising on the expected gain. Therefore, you eliminate the risk or volatility with a limited profit. And you can use options algo trading to help you implement the covered call strategy in your options investments.

A fine example of a covered call is when you purchase a stock with $60, assuming the price goes up about $70 in 10 years, yet sell the stock at $65 within six months to avoid the risk of stock at the same time compromising on the expected gain. Therefore, you eliminate the risk or volatility with a limited profit. And you can use options algo trading to help you implement the covered call strategy in your options investments.

5. Condor

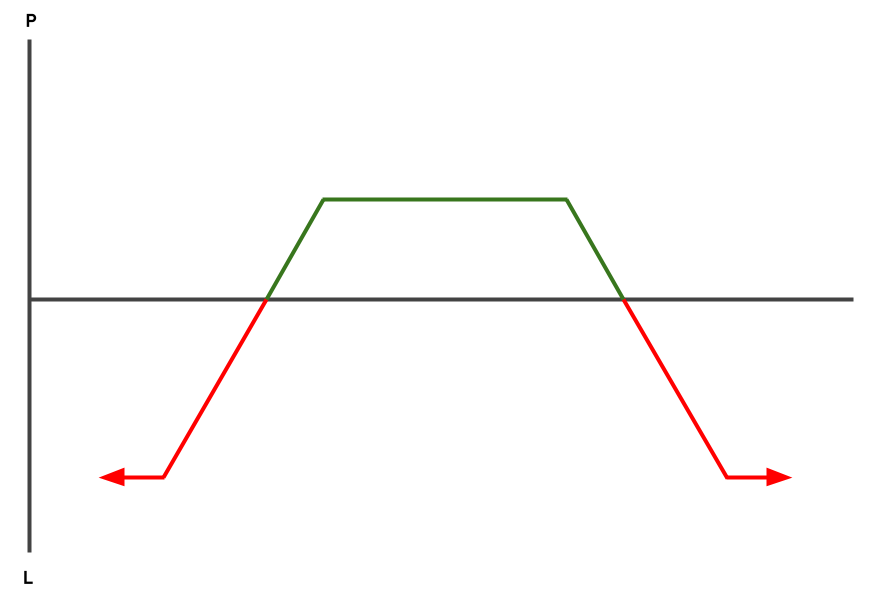

The Condor strategy is the last yet one of the most popular neutral options treading in our list. Condor is similar to the butterfly spread strategy but primarily uses vertical spread charts. Iron condor involves two calls, ie. Short and long calls, two puts- long and short and four different price strikes but with the same expiration. The condor or iron condor is further divided into two different types- long and short condors.

Long Iron Condor

It includes selling a put (lower strike), purchasing a put (lower-mid strike), buying a call (higher-mid strike), and then selling a call with a higher strike.

Short Iron Condor

The short iron condor includes a bull put and a bear call strike with the same expiration date.

Conclusion

Options trading is one of the fastest growing investment sectors that attract many new and pro investors due to the potential profits it offers. The neutral trading trend is one of the most helpful investment trends in the options market that helps investors when uncertain about the market's price movement.

The neutral trend consists of several beneficial strategies, and above, we have covered the top 5 neutral strategies. You can use options Algo trading or automated option trading to implement these strategies.

The neutral trend consists of several beneficial strategies, and above, we have covered the top 5 neutral strategies. You can use options Algo trading or automated option trading to implement these strategies.

Download our Mobile App